Balancing the books for your recruitment agency becomes much simpler with the aid of recruitment factoring. Explore its mechanics and uncover our selection of the UK’s top recruitment factoring firms

Navigating the myriad expenses, from office rentals to marketing outlays, poses a significant cash flow challenge for recruitment enterprises. While recruitment factoring offers substantial relief, pinpointing the ideal provider can be daunting.

Fortunately, aid is within reach. Leveraging two decades of small business expertise, we’ve meticulously scrutinised UK’s recruitment invoice factoring landscape.

Here are the cream-of-the-crop selections:

- Sonovate: Renowned for its agility and transparency, Sonovate stands as an ideal ally for recruitment SMEs, boasting standard bad debt protection.

- Bibby Financial Services: Backed by decades of experience and a stellar track record in customer service, Bibby is tailored for ambitious recruitment ventures.

- Calverton Finance: Since 2006, Calverton Finance has been supporting recruitment enterprises with its seasoned team adept at catering to small businesses.

- Hitachi Capital UK: Among the nation’s largest invoice finance providers, Hitachi Capital offers a six-month no-obligation trial period along with in-person business visits by its relationship management team.

For bespoke guidance in finding your perfect recruitment factoring match, share insights about your business to receive tailored quotes from leading UK recruitment factoring firms.

Alternatively, delve deeper into the aforementioned companies, gain valuable advice on selecting a recruitment factoring partner, understand the process intricacies, and ascertain associated costs.

The UK’s best recruitment factoring companies

When it comes to recruitment factoring, the market offers abundant choices. However, our top selection of the leading four UK recruitment finance firms comprises Sonovate, Bibby Financial Services, Calverton Finance, and Hitachi Capital.

Each boasts a robust track record and a comprehensive suite of recruitment finance solutions, encompassing recruitment factoring and recruitment discounting.

Sonovate

- Specialising exclusively in recruitment finance,

- Offering flexible 30-day rolling contracts,

- Providing a comprehensive cloud-based recruitment solution,

Sonovate has experienced rapid growth since its inception in 2012. By 2015, it had secured the ninth spot in that year’s Startups 100, and its expansion has only accelerated, surpassing the £1 billion mark in terms of funded invoice value.

Why? In an industry often muddled with financial complexities and ambiguous terms, Sonovate stands out for its flexibility and transparency. With a simple fee structure (a percentage of your turnover), inclusive bad debt protection, and the freedom to select invoice finance for as many or as few clients as desired, Sonovate simplifies the process. Once onboarded, you’ll receive 100% of invoice profit the same week a timesheet is approved.

Furthermore, Sonovate’s streamlined cloud-based platform handles nearly all aspects of operations, from credit control to online timesheets, invoicing, and contractor payroll. This leaves recruiters with more time to focus on their core business. Sonovate is dedicated to assisting recruitment firms of all sizes, positioning itself as an ideal partner for recruitment SMEs.

Verdict – For fledgling recruitment enterprises seeking an all-encompassing, adaptable, and transparent solution, Sonovate fits the bill perfectly.

Bibby Financial Services

- With over 35 years of SME funding expertise under its belt,

- Operating on a transparent one-fee structure,

- Offering swift access to cash within 24 hours,

Bibby Financial Services stands as one of the UK’s premier invoice finance companies (and a favoured choice among our invoice factoring companies we recommend), boasting extensive experience in business funding.

Its well-established recruitment finance division is further strengthened by a decade-long collaboration with RSM Employer Services, the UK’s largest bill and pay provider, ensuring comprehensive recruitment finance solutions coupled with robust back-office support.

Similar to Sonovate, Bibby adopts a straightforward one-fee structure and flexible one-month rolling contracts, supplemented by an intuitive online platform enabling 24/7 funding visibility. Upon activation of your recruitment finance facility, you’ll gain access to up to 100% of invoice value within 24 hours post-approval, along with optional bad debt protection.

What sets Bibby apart, however, is its personalised approach, leveraging its 19 UK offices and a team of seasoned professionals, many with prior experience in recruitment agencies. This commitment to exceptional customer service is evidenced by Bibby’s outstanding Trustpilot score of 4.5 from nearly 400 reviews (notably, this rating pertains to the overall company, rather than its recruitment finance segment)

Verdict – With an impressive track record and a reputation for exemplary customer service, Bibby emerges as the perfect choice for those seeking a funding partner with proven longevity and quality service.

Calverton Finance

- With over two decades of expertise in business funding,

- Providing both recruitment factoring and recruitment invoice discounting solutions,

- Operating on a straightforward one-fee structure,

Calverton Finance, headquartered in Milton Keynes, boasts a lengthy history of supporting SMEs and recruitment enterprises. Established in 1998, the company introduced PayFactory, its comprehensive recruitment finance and back-office solution, in 2006.

In addition to PayFactory, which integrates payroll, invoicing, collections, and finance functionalities, Calverton offers standalone recruitment factoring and discounting services—ideal for businesses with established processes seeking to unlock the value of unpaid invoices.

In terms of financing, Calverton pledges to advance up to 90% of invoice value upon invoice generation, with a single fee calculated as a set percentage of the invoiced amount. Catering to recruitment businesses of all sizes, Calverton boasts a seasoned team dedicated to assisting emerging recruitment SMEs.

Verdict – For sizable recruitment enterprises equipped with their own payroll and collections infrastructure, Calverton Finance’s standalone recruitment factoring/discounting service presents an appealing choice.

Hitachi Capital UK

- With over 35 years of industry experience under its belt,

- Offering a unique six-month trial period,

- Integration with Sage Payroll,

Hitachi Capital has long been a stalwart in funding recruitment businesses and ranks among the UK’s largest invoice finance companies.

Similar to Calverton, Hitachi extends both standalone recruitment factoring/discounting and a comprehensive service integrating with Sage Payroll, managing payroll, invoicing, collections, and finance.

Hitachi disburses up to 100% of net or 90% of gross invoice value, with the option for a CHOCCS (Client Handles Own Credit Control) arrangement for businesses preferring to handle payment collections independently. Optional bad debt protection is available.

What truly sets Hitachi apart is its distinctive six-month trial period, offering businesses the opportunity to assess the suitability of recruitment finance without commitment. Following this trial, a flexible six-month rolling contract ensues.

Furthermore, Hitachi prides itself on its personalised and supportive approach, exemplified by a dedicated relationship management team providing in-person support and sharing insights from their wealth of experience. It’s therefore no surprise that Hitachi boasts an impressive Trustpilot rating of 4.8 from 447 reviews (note: this rating pertains to the company overall, not specifically to its recruitment finance services).

Verdict – With extensive expertise in lending tailored to the recruitment sector, Hitachi offers a distinctive six-month trial, making it an ideal opportunity to explore how recruitment factoring could benefit your business.

Choosing a recruitment factoring company

When considering recruitment factoring or discounting, it’s crucial to seek a long-term partner for your company – one who comprehends your operations and aids your success.

Thoroughly compare different companies and assess the services you truly require. Are you seeking merely financial assistance, or do you desire a comprehensive solution that streamlines administrative tasks, allowing you to focus on recruitment?

Opting for the cheapest provider seldom yields favourable outcomes. Inquire about their prior experience, particularly within your sector, to ensure alignment with your business needs.

Scrutinise the terms and conditions meticulously to uncover any hidden charges or fees. If any aspect remains unclear, a reputable recruitment factoring company will patiently clarify any financial jargon.

Selecting a recruitment finance company that aligns with your operational methods is paramount. As Caroline Plumb, CEO of cashflow management software company Fluidly, advises, understanding how the lender handles timesheets is crucial. Ensure the process aligns with your existing workflow or explore how it could be integrated smoothly.

Additionally, consider the preference of invoice finance companies for funding contracts over permanent roles. Verify compatibility with your business model and future expansion plans.

This thorough evaluation will avert potential pitfalls associated with unsuitable funding agreements. To kick-start your comparison process, provide details about your circumstances to receive tailored quotes from leading UK recruitment factoring companies, tailored precisely to your requirements, facilitating the selection of the ideal fit for your business.

How does recruitment factoring work?

As previously discussed, recruitment factoring, also referred to as recruitment finance, represents a niche segment within invoice factoring, or invoice finance.

In essence, you remit a fee to the recruitment factoring company, which, in turn, promptly disburses the bulk of the invoice value shortly after receipt. Subsequently, your client remits their payment directly to the factoring company.

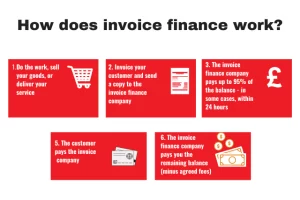

The infographic below offers a simplified breakdown of this fundamental process:

The distinctive advantage for recruitment firms lies in the ability of recruitment factoring companies to advance funds not only against invoices but also against approved timesheets—a boon for agencies focusing on temporary placements.

This funding mechanism can significantly impact your business operations, as highlighted by Dan Benson, a specialist at recruitment finance firm Easypay:

“It’s widely acknowledged that the majority of recruitment agencies, be it for temporary or permanent roles, encounter substantial delays between disbursing payments to candidates or suppliers and receiving client payments on invoices. Standard practice sees delays of up to 60 days, with some instances extending even further.

“For businesses aiming to expand or recruiters seeking independence, the erratic nature of cash flow and its ensuing unpredictability pose significant challenges. Unfortunately, traditional financial institutions fail to grasp this reality and subject their clients to escalating charges and fees. An alternative approach offering a more secure cash flow injection than conventional funding methods becomes imperative. This is where invoice finance steps in.

“With a comprehensive recruitment funding solution, a dependable cash flow injection ensures business accounts maintain a consistently healthy balance.”

While utilising recruitment factoring may entail slightly higher costs compared to relying on delayed client payments, the peace of mind and financial stability afforded by a steady influx of cash into the business are invaluable.

Recruitment factoring vs recruitment discounting

When considering recruitment finance, you’ll need to choose between recruitment factoring and recruitment discounting.

The key difference is that with recruitment factoring, the factoring company handles client payments, freeing up your time for recruiting. However, this convenience comes at a higher cost compared to recruitment discounting. Additionally, factoring is typically not confidential, as the factoring company directly contacts your clients.

Some companies, like Bibby Financial Services, offer confidential recruitment factoring where the factoring company presents itself as part of your company. However, this option is more expensive and less common.

On the other hand, recruitment discounting is cheaper and maintains client relationships as you handle payment collection yourself. However, to qualify for this option, the finance company must be confident in your ability to ensure timely client payments.

In summary, factoring is pricier, not confidential, but saves time and stress, while discounting is cheaper, confidential, but requires you to chase client payments.

Most recruitment finance companies provide both options, so carefully assess your recruitment business to determine the best fit.

Whether you opt for recruitment factoring or recruitment discounting, recruitment finance offers three significant advantages over traditional business finance such as unsecured business loans:

✅ Flexible Funding: Recruitment invoice finance is directly linked to the value of your invoices/timesheets. As your business grows, so does your available funding. This dynamic model eliminates the constraints of fixed interest rates and ensures that your cash flow keeps pace with your company’s expansion.

✅ Comprehensive Support: Leading recruitment factoring/recruitment discounting companies offer more than just funding. Their comprehensive solutions encompass essential administrative tasks such as payroll and contract generation, allowing you to focus on running your business while they handle the administrative burden.

✅ Industry Understanding: Recruitment finance companies have a deep understanding of the recruitment sector. Many of their staff have either worked directly in recruitment or have extensive experience working with recruitment firms. This ensures that you receive funding solutions tailored to your business needs, accounting for the seasonal nature of recruitment. Moreover, these companies often provide guidance and support beyond funding, serving as genuine partners for your business.

If you’re interested in exploring how recruitment factoring can help you achieve your business goals, simply share a bit about your business needs to receive customised quotes from some of the UK’s leading recruitment factoring companies, tailored specifically to your circumstances.

Bad debt protection

As you compare recruitment factoring companies, you’ll notice an optional feature commonly offered: bad debt protection, also known as credit protection.

Essentially, this service shields your business from the risk of clients experiencing financial difficulties and defaulting on payments. For an additional fee, the recruitment finance company assumes the financial loss in such scenarios, rather than your business.

The cost of bad debt protection varies based on the creditworthiness of your clients. Some lenders even permit you to selectively opt for protection on specific clients rather than your entire portfolio.

Deciding whether bad debt protection is suitable for your business hinges on your individual circumstances. Nonetheless, it serves as an additional safeguard in an often volatile and unpredictable business environment, potentially alleviating numerous sleepless nights.

How much does recruitment factoring cost?

Determining the precise cost of recruitment factoring isn’t straightforward, as it varies depending on the specifics of each arrangement. The total expense is influenced by factors such as the level of back-office support provided and the financial strength of your business, as well as the reliability of your clients.

Typically, a well-established business with robust clients poses less risk for the recruitment factoring company, resulting in lower costs compared to higher-risk businesses with less established track records or less financially secure clients.

While a common structure involves both a service fee (covering the cost of provided services) and a borrowing fee (akin to interest on advanced funding), an increasing number of providers are adopting a simplified one-fee structure. For more insights on invoice factoring costs, you can refer to our detailed piece on the topic.

To obtain a tailored estimate of recruitment factoring costs for your business, share some details about your recruitment enterprise. We’ll then provide bespoke quotes from leading recruitment finance companies in the UK, precisely aligned with your requirements.

Final thoughts

Finding the right solution for your recruitment business can propel it to new heights with the assistance of recruitment factoring or recruitment discounting.

The advantages are evident: flexible funding that scales alongside your business growth and a finance partner well-versed in the intricacies of the recruitment sector. However, before diving in, there are crucial considerations to ponder.

Do you prefer the additional support provided by recruitment factoring, or do you value the inherent confidentiality of recruitment discounting? Similarly, are you solely focused on unlocking the value of your invoices, or do you seek a comprehensive back-office solution encompassing payroll, invoicing, and credit control? Lastly, are you inclined to invest in bad debt protection to mitigate the risk of client financial instability?

Clarifying your preferences in a recruitment finance company streamlines the decision-making process. It’s essential to find a partner aligned with your current business practices and future aspirations to ensure mutual understanding before committing.

Although it demands thorough research and deliberation, selecting the right fit for your business can yield significant dividends in the long term.

Seasoned professional with a strong passion for the world of business finance. With over twenty years of dedicated experience in the field, my journey into the world of business finance began with a relentless curiosity for understanding the intricate workings of financial systems.